Learn about the Different Types of Pet Insurance Coverage

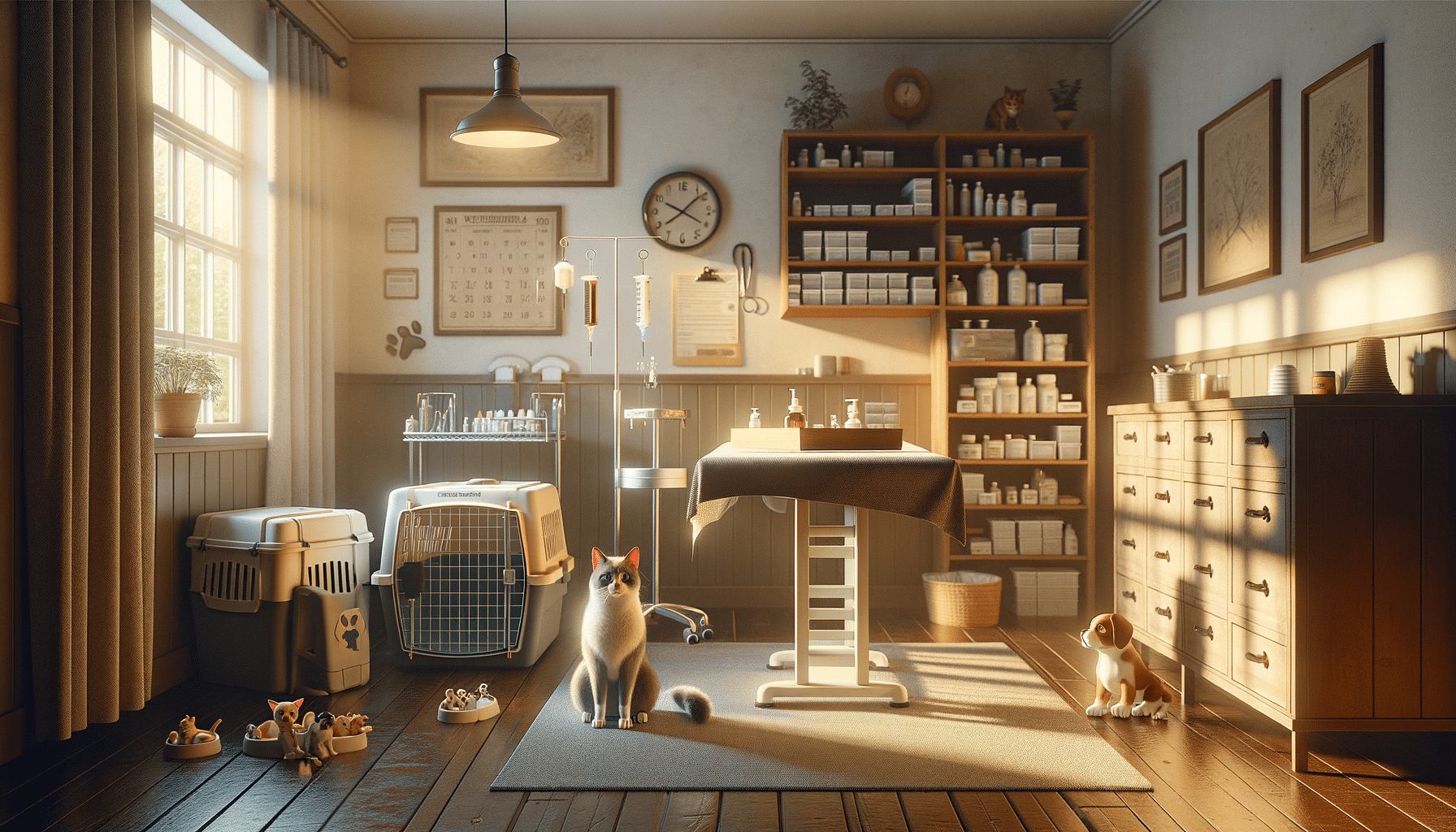

Introduction to Pet Insurance

Pet insurance has become an increasingly important consideration for pet owners who wish to ensure the health and well-being of their furry companions. With the rising costs of veterinary care, having a safety net can alleviate the financial burden when unexpected medical issues arise. Pet insurance policies offer a range of coverage options tailored to different needs, making it crucial for pet owners to understand what each plan entails. This article delves into the various types of pet insurance coverage, helping you make informed decisions for your beloved pets.

Understanding Basic Pet Insurance Coverage

Basic pet insurance is often the starting point for many pet owners exploring coverage options. These plans typically cover accidents and illnesses, providing a financial cushion for unexpected events. A significant benefit of basic coverage is its ability to cover a wide range of medical treatments, including surgeries, hospital stays, and medications. However, it is crucial to note that routine check-ups and preventive care might not be included.

When selecting a basic pet insurance plan, pet owners should consider the following aspects:

- Deductibles: The amount you pay out-of-pocket before the insurance kicks in.

- Premiums: Monthly or yearly payments to maintain the coverage.

- Reimbursement Levels: The percentage of the vet bill that the insurance will cover after the deductible.

These factors play a pivotal role in determining the overall affordability and suitability of the plan. By understanding these elements, pet owners can choose a plan that aligns with their financial capabilities and their pet’s health needs.

Exploring Comprehensive Pet Insurance Plans

For those seeking more extensive coverage, comprehensive pet insurance plans offer a broader range of benefits. These plans often include coverage for accidents, illnesses, hereditary conditions, and even alternative therapies. Some comprehensive plans may also cover routine care, such as vaccinations and annual exams, which can be a significant advantage for proactive pet health management.

Comprehensive plans are ideal for pet owners who want peace of mind knowing that a wide array of potential health issues are covered. However, these plans usually come with higher premiums. To balance cost and coverage, pet owners should evaluate:

- Lifetime Limits: The maximum amount the insurance will pay over the pet’s lifetime.

- Annual Limits: The maximum amount the insurance will pay each year.

- Exclusions: Specific conditions or treatments not covered by the plan.

By carefully examining these factors, pet owners can select a comprehensive plan that offers the best protection for their pets without overextending their budget.

Accident-Only Pet Insurance: A Budget-Friendly Option

Accident-only pet insurance is a cost-effective alternative for pet owners primarily concerned with covering unforeseen accidents. These plans are designed to offer financial assistance for injuries resulting from accidents, such as fractures, burns, or poisonings. While accident-only plans do not cover illnesses, they provide a safety net for unexpected incidents that can lead to hefty veterinary bills.

Accident-only insurance is particularly suitable for younger, healthy pets or for owners who cannot afford more comprehensive coverage. When considering an accident-only plan, pet owners should evaluate:

- Coverage Limits: The maximum amount the insurance will pay for a single accident.

- Exclusions: Specific accidents or circumstances that may not be covered.

- Claim Process: The ease and speed of filing and receiving claims.

By understanding the scope and limitations of accident-only insurance, pet owners can make an informed decision that provides essential protection without unnecessary financial strain.

Choosing the Right Pet Insurance for Your Needs

Selecting the appropriate pet insurance requires a careful assessment of both the pet’s health needs and the owner’s financial situation. While comprehensive plans provide extensive coverage, they may not be necessary for every pet. Conversely, basic or accident-only plans might be insufficient for pets with chronic conditions or those prone to illnesses.

To choose the right plan, pet owners should:

- Evaluate the pet’s health history and potential future health risks.

- Consider the financial implications of different coverage options.

- Research various insurance providers to compare their offerings and customer reviews.

Ultimately, the goal is to find a balance between adequate coverage and affordability, ensuring that your pet receives necessary medical care without financial hardship. By taking the time to research and compare plans, pet owners can secure a suitable insurance policy that meets their unique needs.

Conclusion: Securing Your Pet’s Health with Insurance

Pet insurance serves as a valuable tool for safeguarding the health and well-being of your furry friends. By understanding the different types of coverage available, pet owners can make informed decisions that align with their pet’s needs and their financial capabilities. Whether opting for basic, comprehensive, or accident-only plans, the key is to ensure that your pet is protected against unforeseen medical expenses. With the right insurance, you can provide your pet with the care they deserve, giving you peace of mind and financial security.